in das vergangene Jahr hat 50% übertroffen25."Die Gewinne der Energie Speicherung sind immer noch beträchtlich"Ob es große Speicher oder industrielle und gewerbliche Energiespeicherung, ist, es ist nicht ungewöhnlich , Preise zu sehen

halbieren im Energiespeicherbereich. Das Extrem "Involution" hat die Branche zum Ausruf gebrachtunrentabel für eine lange Zeit, aber nach den halbjährlichen Berichten zu urteilen, die vor Kurzem von Unternehmen der Energiespeicherbranche veröffentlicht wurden, scheint dass ihre Gewinne sind ziemlich beträchtlich und "verlockend".

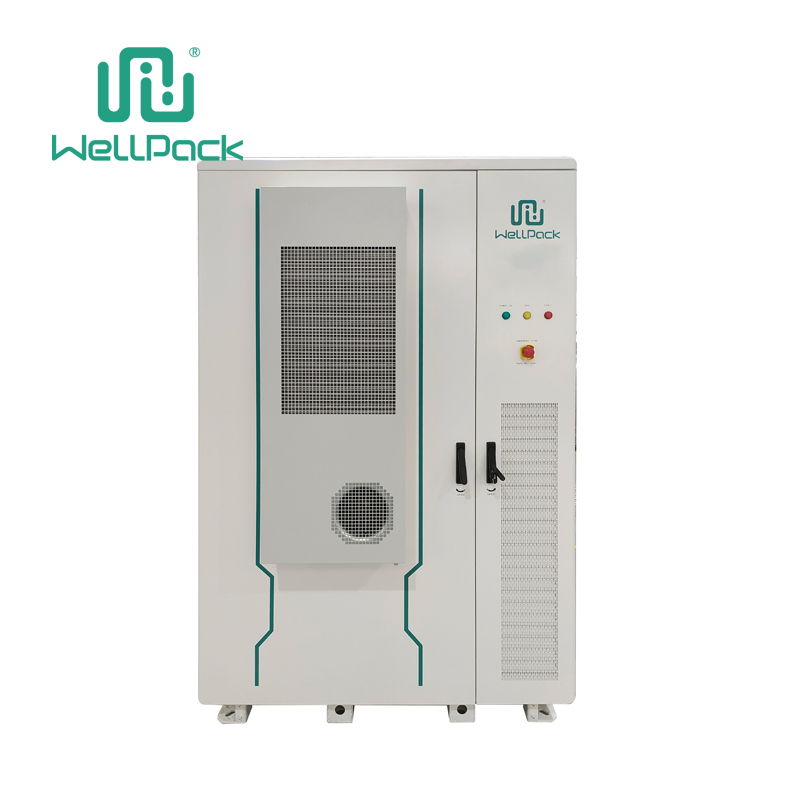

Das Unternehmen mit der höchsten Gewinnmarge ist Sungrow Power Supply, , das als Energiespeichersystem-Integration fest an der Spitzenposition liegt Hersteller. Im ersten Halbjahr dieses Jahres, Die Bruttogewinnmarge des Energiespeichersystems lag bei 40,8 % , und seine zuständige Person hat das gesagtEs gibt vorerst keine Obergrenze für die Energiespeicherung und es wird erwartet , dass in der Zeit eine relativ hohe Wachstumsrate aufrechterhält Zukunft ."Was die Geschäftsabdeckung betrifft, ist sein Betriebseinkommen im Ausland nahezu gleichwertig mit dem des inländischen Marktes und der Abdeckung seiner Auslandsmärkte viele Regionen wie "Europa, Amerika, Mittlerer Osten, und Asien Pazifik . Vor Kurzem hat es häufig große Auslandsaufträge, unterschrieben,wie eine Lieferung Vereinbarung für einen 1,4GWh PowerTitan 2.0 flüssigkeitsgekühltes Energiespeichersystem mit Penso Power, a British renewable energy and energy storage company, and BW BW ESS , ein Investmentunternehmen, und erreichte ein Energiespeichersystem von über

1 GWh mit Spearmint in den Vereinigten Staaten , und unterzeichnete einen Energiespeicherprojekt mit Saudi-Arabien ALGIHAZ mit einer Kapazität von bis zu 7,8 GWh . Allein der Gesamtumfang dieser drei Projekte hat erreicht"10,2 GWh" .

01

Was Batterieunternehmen betrifft

, im ersten Hälfte dieses Jahres,

die Bruttogewinnmarge von CATL's >nergie Speicher Batteriesystem war 28,87%, eine Steigerung im Vergleich zum Vorjahr um 7,55%; die Bruttogewinn Marge von EVE Energie's Energie Speicher Batterie erreicht 14,38%;

die Bruttogewinnmarge von Gotion High-Tech's >nergie Speicher Batteriesystem war 23,87%; die Bruttogewinnmargen von Narada's

inländische und ausländische Energiespeicher systeme waren 24,29% bzw. 32,22% .Gleichzeitig werden überseeische Märkte immer zu der Reichtum Code für führende Energiespeicherunternehmen, die hohe Gewinne und hohe Renditen anstreben. Zu einer Zeit, in der der globale Energiespeicher markt nach und nach größere Freigaben freigibt Nicht nur die führenden Energiespeicherunternehmen, sondern die Mehrheit der zweit- und drittklassigen Hersteller können ihre richtige Positionierung finden , tauchen in Produkte und Dienstleistungen ein,, und vielleicht rollen aus einer neuen Welt mit ihren eigenen wettbewerbsfähigen und differenzierten Routen. . In Section 3, the bids of 19 bidding companies ranged from 0.498 yuan to 0.608 yuan/Wh, and BYD ranked first with a bid price of 0.498 yuan/Wh .

In Section 1, 23 companies offered bids ranging from 0.301 yuan to 0.609 yuan/Wh, and Xuji Electric was pre-bid with a bid price of 0.495 yuan/Wh, which was one of the top three low bids . Similarly, in Section 4, 18 companies offered bids ranging from 0.552 yuan to 0.671 yuan/Wh, and Haibosichuang was pre-bid with a bid price of 0.584 yuan/Wh , the second lowest price.

It can be seen that "low price" seems to have become a tried and tested competitive means for energy storage companies to "win orders". Although continuous cost reduction is inevitable for the development of the industry, Liu Jincheng of Yiwei Lithium Energy believes that "the cost reduction of energy storage systems in the future will not rely mainly on the reduction of battery cell costs, but on the reduction of system standardization costs."

In terms of battery cell prices, the average price of energy storage batteries has dropped from 0.9 yuan to 1.0 yuan/Wh at the beginning of 2023 to the current 0.3 yuan to 0.4 yuan/Wh, a drop of two-thirds. Regarding the future trend, Liu Jincheng said, "In the future, the price of energy storage batteries should remain stable, or even a little higher, which is healthy for the industry." " The industry should focus on technological innovation and performance improvement to enhance the market value of energy storage batteries, and can no longer rely on blindly lowering prices to compete. "

At the same time, relevant persons in charge of CATL also expressed similar views, believing that the stage of rapid decline in lithium battery costs has passed. In the future, when there are no major fluctuations in raw material costs, companies will have to rely more on technology upgrades, process improvements, industrial chain cooperation and new scenario development to further tap the potential for cost reduction.

02

Price falls below 0.6 yuan/Wh, industrial and commercial energy storage "low price" competition emerges

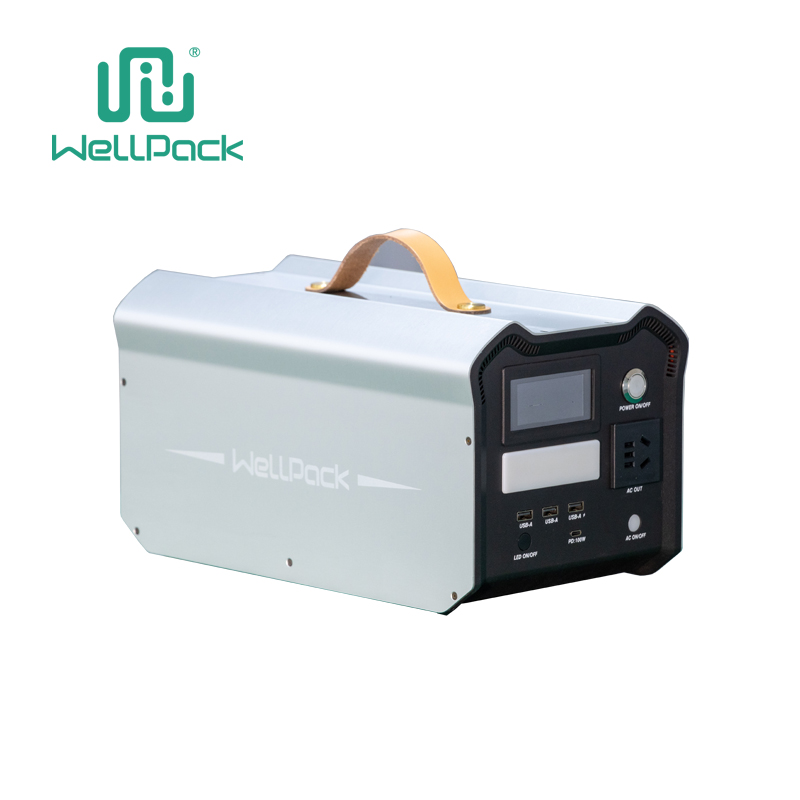

Following the pace of large-scale storage bidding prices continuously falling below the reserve price, the recent topic of industrial and commercial energy storage price bottom line breaking through 0.6 yuan/Wh has also become a hot topic.

At the EESA Energy Storage Exhibition, the most obvious feature was the "price war". The Aqua-E series of industrial and commercial storage products launched by Clou Electronics , a subsidiary of Midea Group, used the slogan " Take it home at 0.598 yuan/Wh ", which attracted a lot of attention and topics. It is reported that the price of the A-type battery is 0.598 yuan/Wh , and the price of the version using the CATL battery is only 0.68 yuan/Wh .

Another "unknown" Zhejiang company, Wocheng New Energy, quoted a low price of 0.58 yuan/Wh , and offered preferential conditions of " 0 yuan experience, payment 6 months after installation ", but the industry mostly took a "wait and see" attitude towards this. Some analysts believe that its price positioning is obviously not enough to be equipped with the current mainstream A-grade battery cells, and can only use the second-tier manufacturer brands. As for its competitiveness, it depends on the specific orders it receives.

It is understood that the current quotations of first-tier industrial and commercial energy storage manufacturers are basically above 0.7 yuan/Wh , including CRRC Zhuzhou Institute, which is famous for its "low prices". The comprehensive unit price of industrial and commercial energy storage products newly announced at the end of July is also around 0.7 yuan/Wh. Previously, the low price holder for industrial and commercial energy storage cabinets was still Mingmei New Energy at 0.72 yuan/Wh.

It is worth mentioning that in September last year, Sungrow launched the new PowerStack 200CS series of industrial and commercial liquid-cooled energy storage systems. At that time, the price of a single product was 1.56 yuan/Wh . Combined with the current price, it is obvious that the price reduction in the past year has exceeded 50%.

03

Energy storage profits are still considerable

Whether it is large-scale storage or industrial and commercial energy storage, it is not uncommon to see prices "cut in half" in the energy storage field. The extreme "involution" has made the industry exclaim "unprofitable" for a long time, but judging from the semi-annual reports recently released by energy storage industry chain companies, it seems that their profits are quite considerable and "tempting".

The company with the highest profit margin is Sungrow Power Supply, which is firmly in the top spot as an energy storage system integration manufacturer. In the first half of this year, its energy storage system gross profit margin was as high as 40.8% , and its relevant person in charge said that " there is no ceiling for energy storage for the time being, and it is expected to maintain a relatively high growth rate in the future ."

In terms of business coverage, its overseas operating income is almost equal to that of the domestic market, and its overseas markets cover many regions such as Europe, America, the Middle East, and Asia Pacific . Recently, it has frequently signed large overseas orders, such as a supply agreement for a 1.4GWh PowerTitan 2.0 liquid-cooled energy storage system with Penso Power, a British renewable energy and energy storage company, and BW BW ESS, an investment company, and reached an energy storage system order of over 1GWh with Spearmint in the United States , and signed an energy storage project order with Saudi Arabia ALGIHAZ with a capacity of up to 7.8GWh . The total scale of these three projects alone has reached 10.2GWh .

As for battery companies , in the first half of this year, the gross profit margin of CATL's energy storage battery system was 28.87%, a year-on-year increase of 7.55%; the gross profit margin of EVE Energy's energy storage battery reached 14.38%; the gross profit margin of Gotion High-tech's energy storage battery system was 23.87%; the gross profit margins of Narada's domestic and foreign energy storage systems were 24.29% and 32.22% respectively.

At the same time, overseas markets are increasingly becoming the "wealth code" for leading energy storage companies seeking high profits and high returns. At a time when the global energy storage market is gradually releasing greater demand, not only the leading energy storage companies, but also the majority of second- and third-tier manufacturers can find their correct positioning, delve into products and services, and perhaps "roll" out a new world with their own competitive and differentiated routes.